Can I Pursue an Online Diploma in Wealth Management program from DU SOL?

DU SOL does not provide online diploma programs. Yet, it offers a comprehensive range of online undergraduate and postgraduate degree programs in some subjects.

There are other Universities that are offering online Diploma in Wealth Management, with NMIMS University Online and GLA University Online being the finest and ideal alternatives to DU SOL. The Wealth Management Diploma at these Universities typically last six months to a year and includes a variety of Wealth & Management courses. You can pursue this diploma for INR 15,000 to INR 45,000 per semester at these Universities.

Key Highlights of the Online Diploma in Wealth Management

Those interested in pursuing a career in the financial services business can consider earning an online diploma in wealth management. You can find further information on the Online Diploma in Wealth Management below:

Cost Structure for Online Diploma in Wealth Management

Every semester, the Online Diploma in Wealth Management program costs between INR 15,000 to INR 45,000.

Read MoreDuration of Online Diploma in Wealth Management

Usually, an online diploma in wealth management takes 6 to 12 months to complete.

Read MoreOnline Diploma in Wealth Management Qualifying Criteria

To be qualified for this diploma, you must have a high school diploma or a bachelor’s degree, as well as a fundamental grasp of finance and accounting. Specific programs may also require students to work in the financial services business.

Read MoreApplication Process to an Online Diploma in Wealth Management

Applicants must submit an online application form, a high school diploma or graduation certificate, transcripts, and relevant job experience. In addition, letters of reference, a personal statement, or an admission exam may be required for some programs.

Read MoreCurriculum for Online Diploma in Wealth Management

A wealth management online diploma often includes a variety of topics such as investment analysis, portfolio management, financial planning, risk management, taxation, and estate planning.

Read MoreIs any placement assistance available for an Online Diploma in Wealth Management Holder?

Several colleges that offer online diplomas in wealth management provide diploma holders with career counselling and job placement aid. This might include résumé development, interview preparation, and networking opportunities. Such institutions may also have ties with financial businesses, banks, and other sector employers, allowing graduates to apply for job vacancies and internships.

Read MoreAll Other Specializations of Online Diploma Program

The specializations that can be chosen under the online diploma program are listed here:

Diploma in Computer Applications

Diploma in Web and Application Development

Diploma in Internet of Things

Diploma in Cyber Threats and Security

Diploma in AI And Machine Learning

Diploma in HR Management

Diploma in International Trade Management

Diploma in Marketing Management

Diploma in Supply Chain Management

Diploma in Financial Management

Diploma in Library and Information Science

Diploma in Banking and Finance Management

Diploma in Operations Management

Diploma in Retail Management

Online Diploma in Wealth Management in India | Operating Techniques

The operating techniques for an Online Diploma in Wealth Management are intended to satisfy students’ demands. They might include:

Exams Structure

The online Diploma in Wealth Management exam structure consists of online exams and assignments, with some programs demanding a final project or thesis.

Mode of Delivery

Practically the complete Online Diploma in Wealth Management is delivered online. Students can use a virtual learning environment to access course materials, chat with instructors and classmates, and complete projects.

Grading Standards

The grading standards for an Online Diploma in Wealth Management include performance on assignments, examinations, and participation in discussions. The grading system might be letter grades or a numerical method.

Career Scope

If you hold an online wealth management diploma, you can follow various job opportunities in the financial services business. Some examples are financial advisers, wealth managers, investment analysts, portfolio managers, and financial planners. In addition, graduates may proceed to executive-level jobs in financial organisations or build wealth management businesses with experience and other certifications.

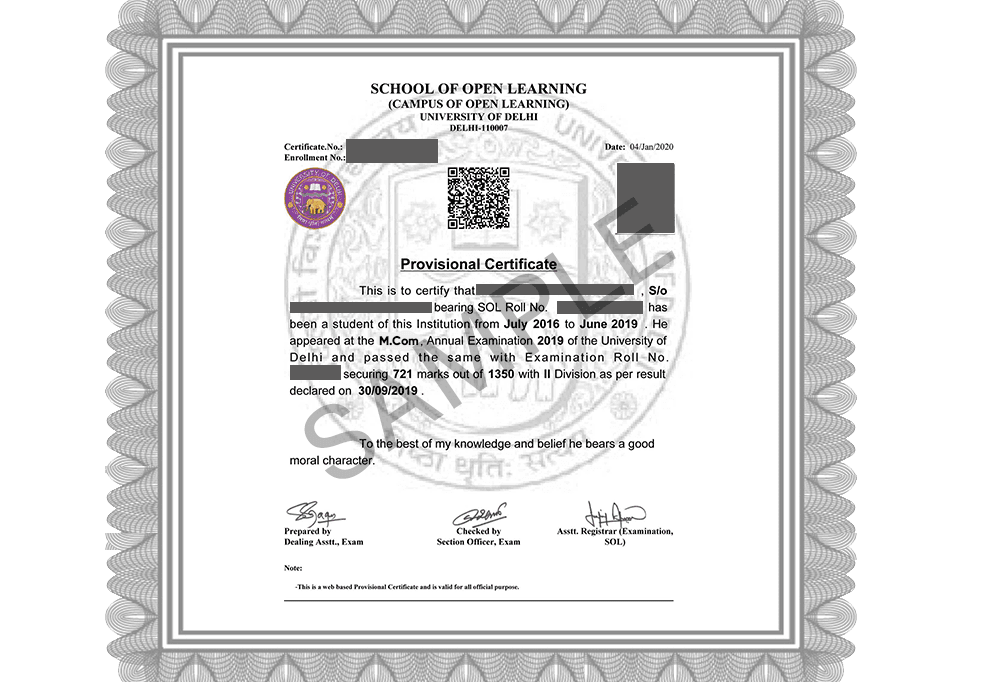

DU SOL Sample Certificate

Earn a UGC & AICTE, NAAC A++ -recognised degree from DU SOL

- Learn from the best faculty and industry experts.

- Become a part of the DU SOL Alumni network.

- Build job-ready skills to get ready for the workforce.

Who is Eligible for School of Open Learning Admissions?

UG Courses

- 10+2 from a recognized Education Board

- A minimum of 45-50% marks in the qualifying exam.

- Basic Knowledge of the English language.

PG Courses

- Graduation from a recognized university.

- At least 45-50% marks in the qualifying exam.

- Must have studied the English language at 10+2 or graduation level.

Note: For some courses, the university might conduct an entrance exam & the eligibility will also depend on the scores of that exam.

DU SOL Admissions FAQ

Graduates with an online Diploma in Wealth Management can work as a financial adviser, wealth manager, investment analyst, portfolio manager, or financial planner in the financial services business. In addition, graduates may proceed to executive-level jobs in financial organisations or build wealth management businesses with experience and other certifications.

The length of an online Diploma in Wealth Management varies according to the university’s delivery. However, the program usually takes 6 to 12 months to complete.

Several universities offering online Diploma in Wealth Management provide financial help to qualified students through scholarships, grants, and loans. When applying for financial aid, it is critical to examine the financial aid alternatives available at each institution and to identify the qualifying criteria.