Last Date of Admission in Online B.Com in Auditing and Taxation from DU SOL

Admission to this online program in Delhi University’s School of Open Learning starts in July. The exact dates for registration & application form filling can be obtained from the official website for each new academic session. All the relevant updates regarding the commencement of the admission process will be posted on this webpage. The prospectus of the university available online can also be seen to get an overview of this degree program. +

Some Quick Facts about Online B.Com in Auditing and Taxation:

- A merit-based online course.

- Has the same impact as a regular degree.

- A 10+2 with a commerce background is eligible to apply.

- No capping of age.

- Placement assistance.

Key Specifications of the Online B.Com in Auditing and Taxation

A Bachelor’s degree with a specialization in auditing and taxation offers a sound knowledge of tax systems and business strategies. The variety of employment options one can get after earning a UG program is enormous in this case. Learners get to build the skills of implementing the latest business practices in their area of work. Some of the few specifications are discussed here to completely understand the structure of this career-oriented online degree program.

Course Fee

The per semester fee of this 3-year UG degree is between 6,500 INR and 12,850 INR. The cost of the entire course structure ranges from 39,000 INR to 77,100 INR. This program fee is exclusive of the one-time registration fee that ranges from 250 INR to 2,000 INR. A variable amount of examination fee that ranges between 500 INR and 2,500 INR is deposited per year/semester before the conduction of exams. The program fee of the course is deposited as per the university guideline either annually or per semester.

Read MoreCourse Duration

This online UG degree has a minimum duration of 3 years. Each year constitutes 2 semesters. This time duration can be extended for another 3 years. This prolonged course duration has increased the demand for this program for a great number of working professionals. Also, this feature allows students to learn at their own pace.

Read MoreAdmission Procedure

The registration process for each batch of admission is conducted online by the university. After the registration process, personalized login credentials are generated for the candidates. These credentials are used to log in to the admission portal of the university website. After filling in the details in the application form, attach the mandatory documents and deposit the course program fee. The university provides the confirmation of the successful admission to the course through an online slip that contains the enrollment number and other relevant details of the candidates.

Read MoreSyllabus

The industry driven syllabus of this bachelor’s program provides technical training in accounting, auditing, taxation, and finance. The common subjects that lay the foundation of this course include Business Accounting, Basic Accounting, Microeconomics, Macroeconomics, Cost Accounting, Auditing Standards in India, GST, Tax Planning and Procedure, Insurance and Risk Management, Business Mathematics, Business Statistics, etc. The learning of these subjects builds a strong base of business domains in the learners.

Read MoreEligibility Criteria

Any candidate who has completed 12th or equivalent from a reputed Education Board can easily apply to this course. Candidates of any stream in their HSC/12th can apply for admission to this course. Enrollment in this UG program is completely based on the merits and the minimum cut-off is set as 50% by the university.

Read MorePlacement Services

This career-oriented course is one of the great choices to avail tremendous job options. The placement assistance provided by the university through placement drives and campaigns exposes the students to the amount of employability they can get after this course. With the expertise in auditing and taxation in a UG program, candidates can easily get entry-level job offers. The experiences earned with time on-field can help candidates to grab high-end packages.

Read MoreOther Online B.Com Specialization Courses

Here is a list of a few other specializations provided under online B.Com that have a high demand in the industry.

Online B.Com in Accounting and Finance

Online B.Com in Banking and Finance

Online B.Com in Banking and Insurance

Online B.Com in Stock Market Operations

Online B.Com in Business Analytics

Online B.Com in International Business

Online B.Com in Behavioural Finance

Online B.Com in International Finance

Online B.Com in Marketing Management

Online B.Com in E-Commerce

DU-SOL Online B.Com in Auditing and Taxation in India (Find the Best Schools and Degrees)

A UG program of B.Com in Auditing and Taxation strengthens the fundamentals of the core subjects of the selected specializations. This course is quite beneficial for individuals who want to pursue a career option in the fields of tax and auditing. Candidates of this specialization can venture into different domains of accounting, finance, taxation, banking, and auditing. The mode of operation of this course is briefed here.

Study Materials

The entire curriculum of the course is provided in the form of semester-wise study materials. These learning materials are available online on the university website. To get the offline printed study materials, learners need to fill in the request form along with a fee of around 1,300 INR.

Semester Exams

Enrolled candidates need to appear for theory exams once in 6 months. This semester-mode examination pattern should not be missed. In case learners fail to appear for the scheduled theory exams or are not able to score the minimum passing marks then they need to deposit the reappearing fee for the same.

Internal Assessment

Assignments are an integral part of the internal assessment (IA). Along with that some activities, GDs, and quizzes can also be taken up by academic professionals under IA. IA must be completed and submitted before the deadline as this also impacts the final evaluation of the candidates.

Final Evaluation

The final results are based on the assessments of theory exams and internal assessments. The weightage of 30% and 70% is given to the IA and theory papers, respectively in the final evaluation. The overall passing mark required for this degree is 40%.

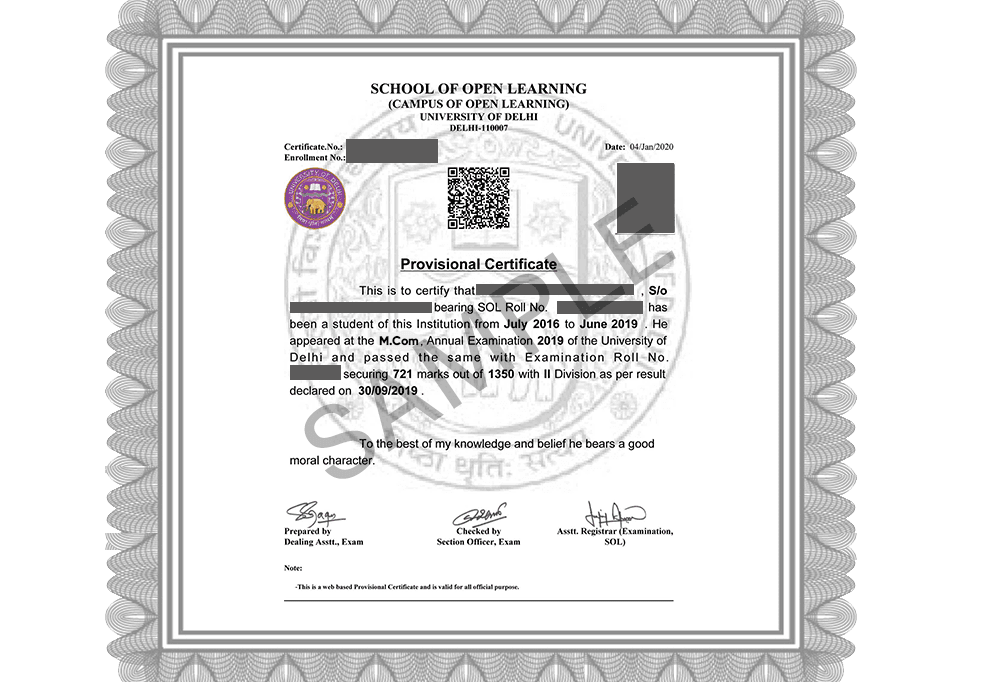

DU SOL Sample Certificate

Earn a UGC & AICTE, NAAC A++ -recognised degree from DU SOL

- Learn from the best faculty and industry experts.

- Become a part of the DU SOL Alumni network.

- Build job-ready skills to get ready for the workforce.

Who is Eligible for School of Open Learning Admissions?

UG Courses

-

10+2 from a recognized Education Board

- A minimum of 45-50% marks in the qualifying exam.

- Basic Knowledge of the English language.

PG Courses

- Graduation from a recognized university.

- At least 45-50% marks in the qualifying exam.

- Must have studied the English language at 10+2 or graduation level.

Note: For some courses, the university might conduct an entrance exam & the eligibility will also depend on the scores of that exam.

DU SOL Admissions FAQ

There is flexibility in the course duration for the online B.Com in Auditing and Taxation. This course can be completed within the span of 3-6 years.

This online UG course of B.Com with specialization in auditing and taxation is approved by UGC-DEB and hence is valid worldwide.

The minimum requirement to get admission in the online UG program of B.Com in Auditing and Taxation is that the candidate must have obtained 50% marks in their HSC or 10+2.